We have loan officers in your community that thrive on helping you find the right mortgage to fit your needs.

Explore various loan program options for fixed and adjustable rate mortgages.

Our mortgage calculators help you hone in on your future mortgage based on options, interest rates, and more.

Get started with our secure application. It's a few quick questions that take about 12 minutes to complete.

MKG Enterprises Corp. is a leading mortgage broker dedicated to providing comprehensive loan solutions, refinance programs, and additional products and programs to meet the diverse needs of our clients. We understand that each individuals financial situation is unique, and we are committed to offering a wide range of options to accommodate various requirements. Whether you are a first-time homebuyer, a seasoned investor, or a self-employed individual, we have the expertise and resources to guide you through the loan process and find the most suitable solution for your specific needs.

At MKG Enterprises Corp., we offer a variety of loan types, including FHA, VA, USDA, Jumbo, Conventional, Commercial, Reverse Mortgage, Non-QM, Bridge Loans, and more. Our extensive range of refinance programs encompasses options such as FHA Streamline, VA Streamline, Conventional, Commercial, and Super Jumbo Loans, providing flexibility and convenience for our clients looking to refinance their existing mortgages.

MKG Enterprises Corp. – Your Partner in Residential, Commercial & Non-QM Mortgage Solutions

MKG Enterprises Corp. is a premier mortgage broker committed to delivering comprehensive, client-focused loan solutions. Whether you're a first-time homebuyer, seasoned investor, or self-employed borrower, our expert team is here to guide you through every step of the loan process with tailored options that fit your unique financial situation.

Residential, Commercial & Non-QM Lending Solutions

We proudly offer a diverse portfolio of loan products to serve a wide range of borrower needs, including:

Additional Products & Supportive Programs

In addition to our loan and refinance offerings, we are proud to provide a range of additional programs to further support our clients.

→ Down Payment Assistance – Bridging the gap to homeownership

→ Self-Employed & 1099 Loans – Tailored options for non-traditional income

→ Rehab Loans – For property improvement and value-add strategies

→ 1031 Exchange Alternatives – Maximize tax savings through structured installment sales

→ Cross-Collateral Loans – Unlock equity without liquidating your investments

Commercial Lending Up to $100MM+ Flexible Capital for Growth

Our Commercial Lending Division specializes in financing opportunities that traditional banks overlook. We offer fast, flexible solutions for:

Permanent Financing Solutions

→ Property Types: Multifamily (5+ units), mixed-use, multi-tenant office, retail, industrial, and hospitality

→ Loan Amounts: Starting at $1MM+

→ Rates: Starting at 6.875%

→ Maximum LTV: 70%

→ Recourse: Full recourse, with non-recourse options for loans below 50% LTV

Construction & Bridge Loan Programs

→ Bridge Loans from $3MM+

→ Construction Loans from $10MM+

→ Stretch Bridge Program up to 75% LTV

→ LTC Up to 55% (Second Position Allowed)

→ Terms: 12–36 Months with Extension Options

→ Flexible Recourse Based on Borrower Strength

Non-QM Solutions: Lending Without Limits

We offer Non-QM mortgage products designed for clients who fall outside traditional lending guidelines:

→ Loan Amounts Up to $30MM+

→ Flexible Documentation – Bank statements, 1099s, or asset-based

→ DSCR Loans – No tax returns required

→ Self-Employed, High-Net-Worth, and Foreign National Options

→ Custom Loan Structuring for unique borrower needs

🔹 Book a Meeting “Non-QM made easy, up to $30MM Commercial Realty!”

🔹Call: (559) 412-7248

CRA Community Reinvestment Act DRIVE

Building Wealth, Strengthening Communities, Driving Equity

At MKG Enterprises Corp., our mission goes beyond loans—we’re committed to transforming communities through the principles of the Community Reinvestment Act (CRA). Our CRA DRIVE initiative is focused on creating equitable access to homeownership, commercial capital, and financial resources in underserved markets across Fresno, Clovis, and Sacramento.

Fresno, CA

Fresno stands at the heart of California’s Central Valley—a region rooted in agriculture and multicultural heritage. As a minority-owned financial services company, we proudly serve this diverse community by offering Down Payment Assistance, Non-QM loans, and financing solutions that promote wealth-building for first-time buyers and historically underserved populations.

Clovis, CA

Clovis thrives on strong community values and civic engagement. Through our CRA-aligned programs, we help Clovis families access affordable financing options and sustainable homeownership opportunities. From first-time buyers to self-employed borrowers, our personalized approach ensures that financial solutions reflect each family’s needs.

Sacramento, CA

As the state capital, Sacramento presents a dynamic blend of public sector, private investment, and residential growth. Through our CRA DRIVE, we contribute to inclusive development by offering commercial and multifamily financing, supporting local entrepreneurs, and extending home financing options to underbanked residents.

Why Clients Choose MKG Enterprises Corp.

→ CRA-focused lending strategies with a commitment to financial inclusion

→ Tailored loan programs for underserved, low-to-moderate income communities

→ Specialized Commercial & Non-QM lending capabilities

→ Transparent, fast, and client-focused service

→ Trusted partner for community-driven development in Fresno, Clovis, Sacramento, San Francisco, San Jose, Silicon Valley, Los Angeles, and San Diego.

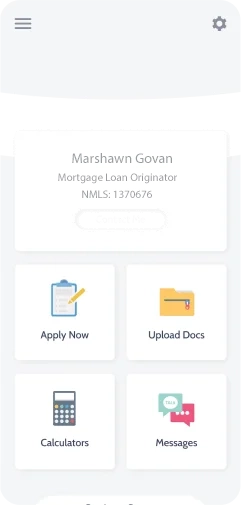

REALTORS • BROKERS • MORTGAGE LOAN OFFICERS — FREE MOBILE APP

The MKG Enterprises Corp Business Pro Connect Mobile App helps you manage your real estate pipeline in one place—capture leads, collect documents, streamline tax and mortgage workflows, and stay connected directly with your clients, loan officers, and realtors.

Built for Real-Estate-Partners (REPs), the app simplifies communication, improves follow-up, and keeps deals moving from first contact to close—without added software costs.

Access Disclaimer: Free app access is available only to approved partners who sign the MKG broker agreement.

Compliance & Disclosures

MKG Enterprises Corp conducts all mortgage origination and related marketing activities in compliance with the Real Estate Settlement Procedures Act (RESPA) and applicable federal and state laws.

MKG Enterprises Corp | NMLS 1370394 | Not a commitment to lend. All loans subject to underwriting and approval.

For California residents only. Marshawn Keith Govan is licensed in CA. MKG Enterprises Corp strives to provide accurate and up-to-date information. However, there may be inadvertent technical or factual inaccuracies, typographical errors, or changes in loan terms that are not immediately reflected in this material. MKG Enterprises Corp makes no warranties or representations as to the accuracy of the information provided and specifically disclaims any liability for errors or omissions. Information presented in this flyer is subject to change without prior notice and should not be considered as financial, legal, or tax advice. Please consult with a qualified professional for specific guidance.

All loan programs are subject to credit approval and property eligibility. Loan terms, interest rates, and guidelines are subject to change at any time without prior notice.

Commercial multifamily loans are intended for investment properties and typically qualify based on property cash flow, rental income, and debt service coverage ratio (DSCR) rather than personal income. Loan approval is subject to lender guidelines, credit evaluation, and property eligibility.

All loan products and services are available to qualified applicants without regard to race, color, religion, national origin, sex, marital status, or any other protected status.

MKG Enterprises Corp (NMLS ID #1370394) is licensed under the California Department of Financial Protection and Innovation (Financing Law License #60DBO-45224). Loans made or arranged pursuant to a California Financing Law license. For licensing information, visit www.nmlsconsumeraccess.org

4021 N Fresno Street Suite 107

Fresno, CA 93726

Phone: (559) 337-5990

homeloans@mkgenterprisescorp.com